Depending on your needs, you may want to consider working with both a bookkeeper and an accountant. Once the bookkeeper posts all transactions, the accountant generates a trial balance that lists all business accounts and balances. Accountants will then use the updated trial balance to produce financial statements. The bookkeeper posts accounting transactions in the general ledger using documents such as receipts, invoices, and other records of business activity.

- A bookkeeper with professional credentials shows a commitment to the trade.

- There’s often overlap, and the duties may change a lot from one business to another.

- Hence, a bookkeeper takes control of the financial documentation process.

- Bookkeepers don’t need a special certification, but a good bookkeeper is important for an accountant to have accurate financial records.

- A CIA is an accountant who has been certified in conducting internal audits.

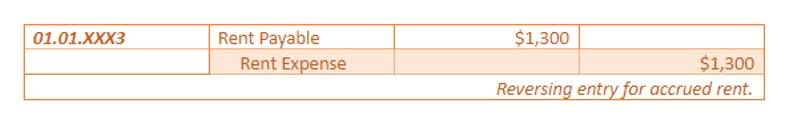

They analyze your books, help you understand what’s working and what needs to change, and they offer the expertise needed to help you move into the next phase of your business. When it comes to the ledger specifically, your accountant might accounting vs bookkeeping determine the accounting method (cash or accrual), then periodically adjust entries to update an account per the chosen method. For the most part, though, your accountant uses the books to assess your business and strategize for the future.

What’s the difference between accounting and bookkeeping?

Many software services combine the two to create a streamlined operation that can make financial recommendations based on recordings. This can be helpful for minor operations, but if you’re serious about maintaining your business’ financial health, you may consider hiring for bookkeeping and accounting services. This can help to ensure your team of financial experts factor in all aspects of your operation before making any major recommendations. The distinctions between accounting and bookkeeping are subtle yet essential. The two careers are similar, and accountants and bookkeepers often work side by side. However, significant differences exist, like work conducted in each career and needed to be successful.

You must have a minimum of 150 postsecondary education hours, or what amounts to a bachelor’s degree in accounting, and an additional 30 hours of graduate work. The NACPB offers credentials to bookkeepers who pass tests for small business accounting, small business financial management, bookkeeping and payroll. It also offers a payroll certification, which requires additional education. Both accounting and bookkeeping play an important financial role in business, there is a difference between the two.

Accountant Role

Maintaining a general ledger is one of the main components of bookkeeping. The general ledger is a basic document where a bookkeeper records the amounts from sale and expense receipts. The more sales that are completed, the more often the ledger is posted. A ledger can be created with specialized software, a computer spreadsheet, or simply a lined sheet of paper. Other programs charge annual or monthly fees and offer advanced features such as recurring invoices or purchase orders.

- Both bookkeepers and accountants need to be comfortable working with numbers all day.

- In most cases, employers want to hire someone with a bachelor’s degree, and a master’s degree may help boost your earnings.

- Smaller public accounting firms tend to pay about 10% less than the “Big Four” for a beginner’s salary.

- Think of your bookkeeper as the one building the foundation of your businesses finances, and your accountant as the architect who designs a house around it, inspecting the foundation.

- To qualify for the title of an accountant, generally an individual must have a bachelor’s degree in accounting.

So, as far as the scope of these two processes is concerned, Accounting is much broader and more analytical than bookkeeping. However, if you find yourself calling your accountant so often that you wish they could be there with you all the time, it may be time to hire full-time help. If you have a freelance bookkeeper working part-time and still falling behind, you may also need to bump them up to full time. But suppose you feel you can improve your financial decision-making process and want to make some adjustments so both restaurant outlets can benefit from an improved system.

Building Better Businesses

For small businesses, adept cash management is a critical aspect of survival and growth, so it’s wise to work with a financial professional from the start. If you prefer to go it alone, consider starting out with accounting software and keeping your books meticulously up to date. That way, should you need to hire a professional down the line, they will have visibility into the complete financial history of your business.